-

Gallery of Images:

-

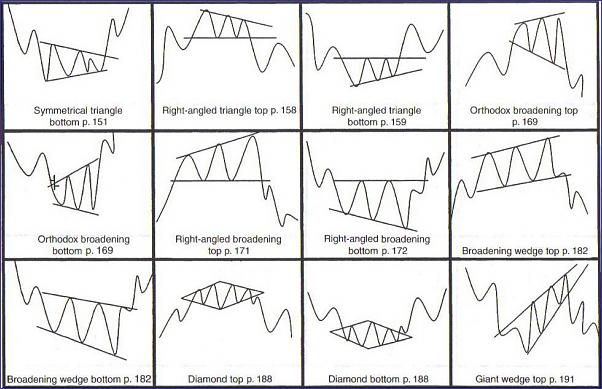

ElliottWave Fibonacci Spread Trading Presented by Ryan Sanden The inevitable disclaimer: Nothing presented constitutes a recommendation to buy or sell any The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Track n Trade is the Ultimate Elliott Wave Trading Platform. I want to give you a couple of examples of how you can integrate Track n Trades many different unique Elliott Wave tools into your own trading strategy to help give you an overall more robust trading system. Track n Trade employs several Elliott Wave tools for identifying and charting the Elliott Wave, both manually as. Elliott Wave Principle Now Available Free Learn all you need to know about applying Elliottwave patterns profitably with this Free online edition of Frost and Prechters Elliott Wave Principle. It is one of the all time best sellers for technical traders and you can be reading the 248 pages of this classic investment analysis manual in minutes. Elliott Wave is a great trading tool for trading trends. However, its not as confusing as a lot people make it out to be when you consider the primary objective of the tool. The Elliott wave trading model was screaming a sell signal! while the rest of the world only saw higher prices. But the Elliott wave signal And then the decline began, an 80 freefall began in July that year. Heres a summary of what we covered regarding the Elliott Wave Theory: . Each wave can be split into parts, each of which is a very similar copy of the whole. com Elliott Wave Trading System. Read this and over 1 million books with Kindle Unlimited. Borrow for free from your Kindle device. Elliott Wave Trading Free Download ( rar files ) Practical Elliott Wave trading strategies. pdf Technical Analysis Course [Trading Gann Elliott Wave Theory. pdf ElliottWaves A Comprehensive Course COMPLETE. pdf Practical Elliott Wave trading strategies. pdf Technical Analysis Course [Trading Gann Elliott. With Gecko Softwares Award Winning Elliott Wave trading tools, we provide numerous Elliott Wave trading tools, how to videos, and educational white papers on how you can integrate Track n Trades many different unique Elliott Wave features into your own trading strategy for. hi guys, im new in this elliott waves. im kinda confuse with which is the end of wave 3 or wave 5. i succesfully identified wave 1 and 2 after wave 2. next is wave 3 but during the impulse move, , theres many pullback which i thought is the end for wave 3 already but its not. how will i know that its the end of wave 3? and same with the wave 5 i tried using the fibonnacci. This is probably what you all have been waiting for drumroll please using the Elliott Wave Theory in forex trading! In this section, we will look at some setups and apply our knowledge of Elliott Wave to determine entry, stop loss, and exit points. Hi all, started this thread to discuss Elliott wave trading. Feel free to discuss and post charts. Rules for EWP: Wave 2 should not break below the beginning of Wave 1. The latest Tweets from Elliott Wave Trading (@TradingEW). Discovering Elliott Wave for optimum entry, exit and risk management of trades. Hong Kong You can lose money trading. If you cannot afford to lose money you should not trade. The FX Traders EDGE, The Elliott Wave Desk and all affiliated individuals assume no responsibility for your trading and investment results. I used to get trading reports from [another Elliott Wave company, but the focus was on technicalities of the wave not on good entry or exit points. Without the translation to market realities, that information was useless to me as a trader. Elliott Wave Trading @PrincplAnalysis I use Elliott Wave Principle to trade forex, futures and stocksoptions. If you're a fellow Waver, come join me and let's talk about some waves. The Elliott wave principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. VIX Forex Trading with Mike Golembesky. About Mike: Michael Golembesky is a featured analyst at focusing on Forex and the VIX. Mike is a renowned practitioner and educator in applying Elliott Wave analysis to trading forex and volatility instruments. Elliott Wave theory is one of the most accepted and widely used forms of technical analysis. It describes the natural rhythm of crowd psychology in the market, which manifests itself in waves. More Trading Tips for Stock Traders at: Every investor should have a bookkeeper or accountant to keep their books straight. The Elliott Wave Theory is interpreted as follows: Every action is followed by a reaction. Five waves move in the direction of the main trend, followed by three corrective waves (a 53 move). On Wednesday, the Fed is expected to raise interest rates. There also seems to be some regulatory issues facing the social media giants. Additionally, China has called off scheduled meetings Trading You can use Elliott wave analysis to help you trade the markets objectively. It helps you identify trends and turning points, find realistic price targets and manage risk with precise stoploss levels putting you miles ahead of other traders. Elliott Wave Theory (EWT) occupies an odd position in market lore, with adherents taking years to master its secrets and skeptical observers dismissing it as voodoo, favoring a more traditional. In this article, we're going to explain what Elliott Wave analysis is, and discuss the best Elliott Wave software for Forex trading. The Elliott Wave principle is a type of technical analysis, developed from theory developed by Ralph Nelson Elliott. When trading with elliott wave, you start at a large degree lets say a daily chart, and work to a lower degree possibly a 30 minute chart. You must form a picture of what the price action is. In this Elliott wave Guide, I will show you what Elliott wave patterns are, how to count Elliott wave patterns correctly. And; How to use an Elliott wave with Fibonacci analysis in your trading. Elliott wave forex traders ultimate guide! Are you looking for a trading method that can seem to help you look into the future! Stick around and I will show you how the. Elliott Wave Forex Trading With The Elliott Wave Theory 4. 2 (222 ratings) Course Ratings are calculated from individual students ratings and a variety of other signals, like age of rating and reliability, to ensure that they reflect course quality fairly and accurately. The Elliott wave theory, ( or some call it the Elliott Wave Principle) Elliott wave analysis and how to trade Elliott Waves can be a mind boggling trading concept to understand especially for a new forex trader. Even though the Elliott Wave strategy is a trend following strategy, we can spot Elliott Wave entry points even on the lower time frames because the Elliott Wave theory can be applied to all time frames and to all markets so, in essence, is a universal trading strategy. Also read the hidden secrets of. Understanding the Basics of Trading with the Elliott Wave Theory. I will now show you a couple of indicators which can assist with Elliott Wave trading. Although they are not directly related to Elliott Waves, they can facilitate the wave identification process. An Elliott wave is defined as the movement from a price peak to a price trough or a trough to a peak. A cycle comprises two waves: an impulse wave and a corrective wave. The Live Trading Room is designed to be used in conjunction with Elliot Wave Forecasts analysis, to give you more insight into the technicals behind the charts, so that you may better develop a trading plan and manage your risk. With the return of market volatility just when many U. markets are at significant Elliott wave junctures its shaping up to be one of the most timely issues weve ever released. Riskfree for a full month, read the current Financial Forecast plus our Theorist and Short Term Update. Charts, forecasts and trading ideas from trader elliottwaveanalysis. Get unique market insights from the largest community of active traders and investors. Elliott wave trading is a wave pattern in Forex or stock trading technical analysis to identify and read the market price trends by determining tops and bottoms in market price. Elliott wave trading is a wave pattern in Forex or stock trading technical analysis to identify and read the market price trends by determining tops and bottoms in. The Elliott Wave may be applied to foreign exchange markets, fixed income, commodity and equity trading. Some support that the use of candlestick signals with the Elliott Wave theory provides the most recent trend direction. Trading with Elliott Waves Elliott Wave Analysis can be combined with any trading strategy, as it provides a blueprint for where the market is heading. If you know whether the instrument is in a trend vs. sideways market, you can use your strategy to trigger the entry in the direction of the trend. Elliott Wave Trading, Lahore, Pakistan. 2, 121 likes 2 talking about this. Elliott Wave Trading is a forex trading company. Access Market Overview, Trend Report, 1 Hour, 4 Hour, Daily and Weekly charts for 26 instruments (of choice). Access all features of Silver Plan with addition of London Midday charts. Daily Technical Video, Weekend Video, Live Analysis Session and 24 Hour Chat Room for 26 instruments (of choice. Elliott Wave Forex Trading Lesson 1 Duration: 9: 21. Daily Forex Trading Plus 10, 226 views. The best way to become a millionaire in five years or less 02 Duration: 22: 01. Trading advice for those who want expert guidance, but don't have time to design their own Elliott Wave trading strategies. The point in using the rules and guidelines of the Elliott Wave Theory is to know where in the overall structure is the market right now, and what portion of that motion are they most likely to. Wave 3 Technical Trading is a service that provides Elliott Wave based market analysis accross a broad range of markets The Wave 3 methodology involves a blend of Elliott Wave, the Fibonacci number sequence, moving averages, timing techniques momentum characteristics, and sentiment indicators. Elliott Wave theory explains this anomaly with the understanding that the markets move based upon public sentiment, and not news. Any seemingly good news that is announced during a negative sentiment period seems to be discounted, and vice versa..

-

Related Images: